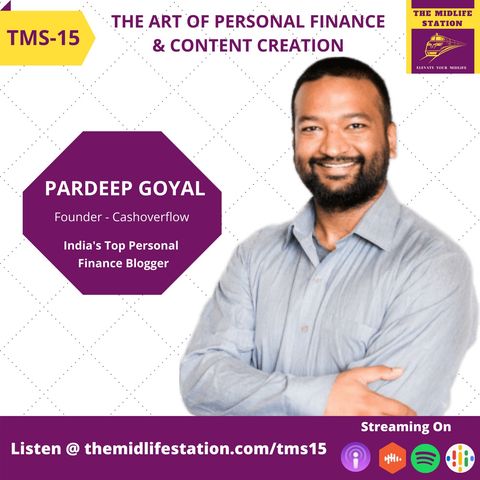

The Art of Personal Finance and Content Creation with Pardeep Goyal:TMS15

Feb 14, 2021 ·

54m 2s

Download and listen anywhere

Download your favorite episodes and enjoy them, wherever you are! Sign up or log in now to access offline listening.

Description

Do you find it difficult to adopt a saving mindset or wonder how to come out of Debt or want to work on alternate sources of Income? On the show...

show more

Do you find it difficult to adopt a saving mindset or wonder how to come out of Debt or want to work on alternate sources of Income?

On the show today we have with us, Pardeep Goyal - Founder of Award-Winning Personal Finance Blog, CashOverFlow which was awarded as the best personal finance blog in 2017 by Indiblogger. He is passionate about sharing his expert insights on value investing,money-saving hacks, and creating an alternate source of income

Prior to starting Cashoverflow, he did face failure in a couple of startups during their initial year of operations. However, these failures didn't deter him from following his passion and becoming one of the key influencers in India in the content writing industry

He has also published numerous insightful articles around Entrepreneurship, PR & Growth Hacking on StartupKarma and Yourstory

Key Points we discussed:

•In the 1st half, we focus on financial challenges that come in during midlife, the challenges related to debts, savings mindset, and also around generating alternate sources of income

•In the latter half, we pick up Pardeep's brain around the future of the content industry, key success principles required in the content business, and how one can become an expert in producing content.

Show Notes:- You can find the show notes for the show by visiting https://themidlifestation.com/tms15

Follow Us:-

•Facebook - https://www.facebook.com/themidlifestation

•Linkedin - https://www.linkedin.com/company/the-midlife-station/about/

•Instagram - https://www.instagram.com/themidlifestation/

•Twitter - https://twitter.com/MidlifeStation

Key Takeaways

•If you have badly stuck in debt then as the first step try segregating debts, between high v/s low-interest one. Try to close high-interest ones like a credit card, either through your savings or by selling things that you do not need. Once this gets fixed, you can move the focus on low-interest ones by using part of your income that you earn on a monthly basis

•One needs to understand the difference between Saving and Investment and shouldn't mix both of them. The primary purpose of Saving is to preserve the money by ensuring it grows at par with inflation whereas the goal of the investment is to earn money and beat inflation. If needed, always hire an investment advisor who can guide you in your investment journey

•Whether you are working on your business or for a company, consistency is the key element that separates successful people from the rest. Ensure that you are consistent in whatever you do, it may be producing content every day or doing exercise every day or taking ownership and showing up every time when there are problems or challenges that you encounter while working in your company or in your business.

Timestamp:-

•03:32 - Why Cashoverflow was started?

•04:55 - Experience and learnings from failed startups

•07:26 - Why he chose finance as a niche for content writing business?

•08:41 - What specific Finance topics Pardeep wanted to share through his writing?

•10:50 - Why do people fall into the debt trap?

•13:46 - How to come out of debt?

•1...

show less

On the show today we have with us, Pardeep Goyal - Founder of Award-Winning Personal Finance Blog, CashOverFlow which was awarded as the best personal finance blog in 2017 by Indiblogger. He is passionate about sharing his expert insights on value investing,money-saving hacks, and creating an alternate source of income

Prior to starting Cashoverflow, he did face failure in a couple of startups during their initial year of operations. However, these failures didn't deter him from following his passion and becoming one of the key influencers in India in the content writing industry

He has also published numerous insightful articles around Entrepreneurship, PR & Growth Hacking on StartupKarma and Yourstory

Key Points we discussed:

•In the 1st half, we focus on financial challenges that come in during midlife, the challenges related to debts, savings mindset, and also around generating alternate sources of income

•In the latter half, we pick up Pardeep's brain around the future of the content industry, key success principles required in the content business, and how one can become an expert in producing content.

Show Notes:- You can find the show notes for the show by visiting https://themidlifestation.com/tms15

Follow Us:-

•Facebook - https://www.facebook.com/themidlifestation

•Linkedin - https://www.linkedin.com/company/the-midlife-station/about/

•Instagram - https://www.instagram.com/themidlifestation/

•Twitter - https://twitter.com/MidlifeStation

Key Takeaways

•If you have badly stuck in debt then as the first step try segregating debts, between high v/s low-interest one. Try to close high-interest ones like a credit card, either through your savings or by selling things that you do not need. Once this gets fixed, you can move the focus on low-interest ones by using part of your income that you earn on a monthly basis

•One needs to understand the difference between Saving and Investment and shouldn't mix both of them. The primary purpose of Saving is to preserve the money by ensuring it grows at par with inflation whereas the goal of the investment is to earn money and beat inflation. If needed, always hire an investment advisor who can guide you in your investment journey

•Whether you are working on your business or for a company, consistency is the key element that separates successful people from the rest. Ensure that you are consistent in whatever you do, it may be producing content every day or doing exercise every day or taking ownership and showing up every time when there are problems or challenges that you encounter while working in your company or in your business.

Timestamp:-

•03:32 - Why Cashoverflow was started?

•04:55 - Experience and learnings from failed startups

•07:26 - Why he chose finance as a niche for content writing business?

•08:41 - What specific Finance topics Pardeep wanted to share through his writing?

•10:50 - Why do people fall into the debt trap?

•13:46 - How to come out of debt?

•1...

Information

| Author | Rupesh Nahar |

| Organization | Rupesh Nahar |

| Website | - |

| Tags |

Copyright 2024 - Spreaker Inc. an iHeartMedia Company