College Station city council receives a proposed FY 23 budget that would reduce the property tax rate and raises most utility rates

Download and listen anywhere

Download your favorite episodes and enjoy them, wherever you are! Sign up or log in now to access offline listening.

Jul 13, 2022 ·

16m 56s

This podcast contains comments from the city of College Station's fiscal services director, Mary Ellen Leonard, from the July 12, 2022 city council meeting. Click the following link to download...

show more

This podcast contains comments from the city of College Station's fiscal services director, Mary Ellen Leonard, from the July 12, 2022 city council meeting.

Click the following link to download the city of College Station proposed FY 23 budget document that was presented at the July 12, 2022 city council meeting: https://wtaw.com/wp-content/uploads/2022/07/CScoun071222BudgetBook.pdf

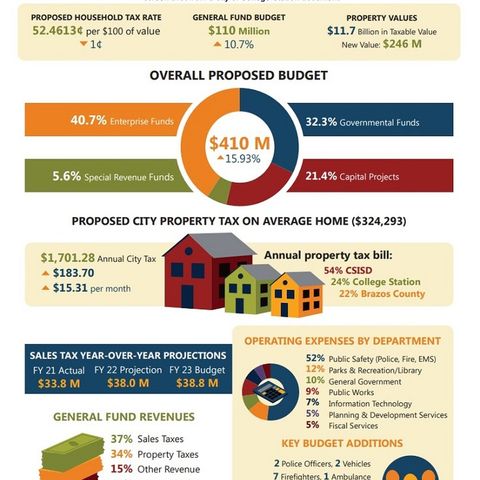

The College Station city council receives a budget proposal for fiscal year (FY) 2023 from staff that includes a one cent decrease in the property tax rate and increases most utility rates by ten percent.

Even with a proposed property tax rate decrease, an estimated increase in property valuation of 11.5%...which fiscal services director Mary Ellen Leonard said could change when final valuation numbers are released...the property tax on a home at the average value in College Station of $324,293 will increase by $183.70.

The proposed budget includes the first increase in electric rates since 2011, along with paying more for trash collection, licenses and permits, and fees for roadway maintenance and drainage. The proposed budget includes the first increase in electric rates since 2011, along with paying more for trash collection, licenses and permits, and fees for roadway maintenance and drainage. That would result in a monthly increase of $13.81 in an average residential utility bill and an monthly increase for multi-family unit customers of $12.40.

The proposal does not call for increasing water and wastewater rates.

City officials are proposing 30 new fulltime equivalent jobs. Identified as "key budget additions" are two more police officers and two more police vehicles, seven firefighters to staff another ambulance crew, three more employees and two more vehicles for trash collection, and a new coordinator/code officer position for the Northgate district.

City employees who are not uniformed police and fire employees would receive a five percent pay increase and would be considered sharing in a merit pay pool of $1.7 million dollars.

Uniformed police and fire employees would receive a 4.5% pay increase, and if they are promoted, they would receive another 2.5% raise.

The budget proposal calls for city employees not paying more for health insurance premiums. The city would pick up the more than 15% price increase.

The budget timeline includes city council budget workshops on July 18, 19, and 20. That is followed by a July 28 public hearing which follows receiving final valuation numbers. Another public hearing on August 3 involves setting the proposed property tax rate. And on August 11, the council will hold a public hearing on the tax rate, consider final adoption of the tax rate, updated fees, and the FY 23 budget.

show less

Click the following link to download the city of College Station proposed FY 23 budget document that was presented at the July 12, 2022 city council meeting: https://wtaw.com/wp-content/uploads/2022/07/CScoun071222BudgetBook.pdf

The College Station city council receives a budget proposal for fiscal year (FY) 2023 from staff that includes a one cent decrease in the property tax rate and increases most utility rates by ten percent.

Even with a proposed property tax rate decrease, an estimated increase in property valuation of 11.5%...which fiscal services director Mary Ellen Leonard said could change when final valuation numbers are released...the property tax on a home at the average value in College Station of $324,293 will increase by $183.70.

The proposed budget includes the first increase in electric rates since 2011, along with paying more for trash collection, licenses and permits, and fees for roadway maintenance and drainage. The proposed budget includes the first increase in electric rates since 2011, along with paying more for trash collection, licenses and permits, and fees for roadway maintenance and drainage. That would result in a monthly increase of $13.81 in an average residential utility bill and an monthly increase for multi-family unit customers of $12.40.

The proposal does not call for increasing water and wastewater rates.

City officials are proposing 30 new fulltime equivalent jobs. Identified as "key budget additions" are two more police officers and two more police vehicles, seven firefighters to staff another ambulance crew, three more employees and two more vehicles for trash collection, and a new coordinator/code officer position for the Northgate district.

City employees who are not uniformed police and fire employees would receive a five percent pay increase and would be considered sharing in a merit pay pool of $1.7 million dollars.

Uniformed police and fire employees would receive a 4.5% pay increase, and if they are promoted, they would receive another 2.5% raise.

The budget proposal calls for city employees not paying more for health insurance premiums. The city would pick up the more than 15% price increase.

The budget timeline includes city council budget workshops on July 18, 19, and 20. That is followed by a July 28 public hearing which follows receiving final valuation numbers. Another public hearing on August 3 involves setting the proposed property tax rate. And on August 11, the council will hold a public hearing on the tax rate, consider final adoption of the tax rate, updated fees, and the FY 23 budget.

Information

| Author | Bryan Broadcasting |

| Website | - |

| Tags |

-

|

Copyright 2024 - Spreaker Inc. an iHeartMedia Company